- India

- Financial

3.5M

0.77%

26928

- India

- Financial

937.0K

0.74%

6829

61

- India

- Financial

478.7K

3.11%

14789

121

- India

- Financial

336.5K

2.08%

6928

70

- India

- Financial

307.7K

0.46%

1382

46

- India

- Financial

179.1K

2.95%

4774

507

- India

- Financial

122.2K

0.74%

894

14

- India

- Financial

116.4K

0.36%

410

4

- India

- Financial

2.0K

0.93%

17

2

- India

- Financial

211

2.51%

5

0

Financial influencers in India are reshaping the way people perceive and manage their finances. With their informative content, they bridge the gap between complex financial concepts and the average individual, making financial literacy more accessible. Their influence extends beyond mere advice; they instill confidence and encourage proactive financial decision-making among their followers.

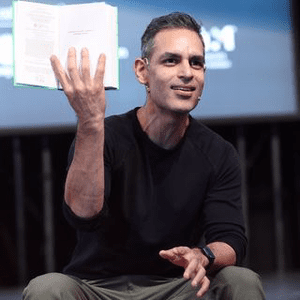

Analyzing the provided data, Ankur Warikoo (@ankurwarikoo) leads the pack with a staggering 3.5 million followers. His engagement rate of 0.77% translates into an impressive average of 26,927 likes and 196 comments per post, highlighting his ability to resonate with a vast audience. Pranjal Kamra (@pranjalkamra) follows with 937,000 followers and a 0.74% engagement rate, bringing in around 6,829 likes and 61 comments per post. Their substantial following and consistent engagement make them influential voices in the financial domain.

Lord Money Engar (@lordmoneyengar) boasts a smaller but highly engaged audience with 478,700 followers and an outstanding engagement rate of 3.11%, averaging 14,789 likes and 121 comments per post. Similarly, Finance by Ankita (@financebyankita) captivates 336,500 followers with a 2.08% engagement rate, while The Mukul Agrawal (@themukulagrawal) garners a 0.46% engagement rate from his 307,700 followers.

For businesses, collaborating with these influencers can be a strategic move. Their credibility and reach provide companies with a direct line to a dedicated audience already interested in financial products and services. By partnering with these influencers, businesses can enhance brand visibility and establish themselves as trusted names in the financial sector.

To sum up, the financial influencers mentioned above have cemented their positions as key players in India’s financial landscape. Their large followings, significant engagement rates, and impactful content make them invaluable allies for brands looking to connect with a financially savvy audience. So, why wait? Dive deeper into the world of these influencers and discover how they can help you achieve your financial goals in 2025 and beyond.

196